Demonetization helped banks improve their fund situation

8th November 2016 day, When Indian Prime Minister Shri Narendra Modi official announce that 500 Rs and 1000 rs. note are note are not more legal tender. country was shocked with the move of the government.

there is probably many benefit with demonetization decision of the government, some are in short run or long. as we are finance professional person we should had to know the clear benefit of demonetization some as follows:

- Fake currency generation and circulation are strokes! As to make one note of 500 Rs or 1000 expense are probably 100 Es, so to make illegal money of below rs 100 are not possible because of higher expense. so make only notes of 500 and 1000 Es., now RBI recall the old all these note and introduce new notes so it is not possible to make notes immediately, its takes to much time to copy a same design and all aspect.

- Reduce Black money Transaction, we know that all money are necessary to deposit in the bank, so it clearly benefits of reduction in black money transaction. and more money circulation come into exist in banking system which direct benefit to government and development.

- terrorism are reduced for some time, not stop because they also need money which comes out of the border.

- it seems like because of demonetization government revenue for P.Y 2016-17 going to increase due to a high collection of tax, interest, and penalty from black money

- Near to making a cashless economy, a cashless India. The majority of Indian have now a bank account and demonetization makes those account more active ever seen.

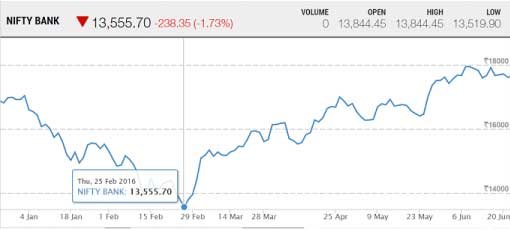

From January 2016 banking sector are going Down due to huge NPA (None performing Assets), Share Price are also reduced very fast, Bank nifty are down from 17000 to 14000 within one month. the growth of infrastructure is also decreasing because bank has not enough fund to provide a load to the weaker sanction of an economy. currency are not circulating because rs 500 and 1000 notes are approx 80% of total amount of cash in an economy which mostly in black money.

So Bank needs fund to provide a load to a various sector to boost economic development, for these bank needs funds to provides loans to Various sectors. hence demonetization increase the liquidity of bank and financial institute can give loans to a different sector. Also NPA going to decrease as everyone is paying their debts whatever they have money in cash

further On Tuesday Union Finance ministry Arun Jaitley said that Demonetization helped banks to improve their fund situation. while addressing the BJP parliamentary party meeting said as a result of demonetization decision, 'Huge amount" of money has come to banking system. which will help the state exchequer and the banking system?

What You Think about Demonetization ? Comment . . .

Leave a Reply